Trading Chart Pattern Book | Includes Candlestick Patterns, Breakout Patterns with Explaination

Trading best book in the market along with high content and full candle stick pattern.

Certainly! Candlestick chart patterns are graphical representations of price movements in financial markets, commonly used in technical analysis to predict future price movements. Here are some common candlestick patterns along with their details:

1. **Doji**: A doji occurs when the opening and closing prices are virtually the same. It indicates indecision in the market and potential reversal. There are several types of doji patterns:

– **Neutral Doji**: The opening and closing prices are very close to each other.

– **Long-legged Doji**: The opening and closing prices are near each other, but there is significant price movement in between, resulting in long upper and lower shadows.

– **Gravestone Doji**: Opening and closing prices are near the low of the day, suggesting potential bearish reversal.

– **Dragonfly Doji**: Opening and closing prices are near the high of the day, indicating potential bullish reversal.

2. **Hammer and Hanging Man**: Both are single candlestick patterns with small bodies and long lower shadows. They suggest potential reversal:

– **Hammer**: Occurs at the bottom of a downtrend, indicating potential bullish reversal.

– **Hanging Man**: Appears at the top of an uptrend, signaling potential bearish reversal.

3. **Engulfing Pattern**: This pattern consists of two candlesticks, where the body of the second candlestick completely engulfs the body of the previous one. There are two types:

– **Bullish Engulfing**: A small bearish candlestick is followed by a large bullish candlestick, suggesting potential bullish reversal.

– **Bearish Engulfing**: A small bullish candlestick is followed by a large bearish candlestick, indicating potential bearish reversal.

4. **Morning Star and Evening Star**: These are three-candle reversal patterns:

– **Morning Star**: The first candle is bearish, followed by a small-bodied candle with a lower low and higher high (the star), and finally a bullish candlestick that closes above the midpoint of the first candle, indicating potential bullish reversal.

– **Evening Star**: The first candle is bullish, followed by a small-bodied candle with a higher high and lower low (the star), and finally a bearish candlestick that closes below the midpoint of the first candle, suggesting potential bearish reversal.

5. **Three Inside Up/Down**: This pattern consists of three candlesticks:

– **Three Inside Up**: A bearish candlestick is followed by a small-bodied candlestick that is engulfed by the third bullish candlestick, indicating potential bullish reversal.

– **Three Inside Down**: A bullish candlestick is followed by a small-bodied candlestick that is engulfed by the third bearish candlestick, suggesting potential bearish reversal.

These are just a few examples of candlestick patterns used by traders to analyze market sentiment and forecast future price movements. It’s important to combine candlestick patterns with other technical indicators for more reliable trading decisions.

Title: Unraveling the Art of Technical and Candlestick Trading in Stock Investing

In the vast landscape of stock trading and investing, two methodologies have emerged as prominent strategies employed by traders worldwide: technical analysis and candlestick charting. These methodologies provide traders with valuable insights into market trends, price movements, and potential entry and exit points. Let’s delve into the intricacies of technical analysis and candlestick charting, exploring how they shape the landscape of stock investing.

**Technical Analysis: Unveiling Market Patterns**

Technical analysis is a trading discipline that evaluates securities and market trends solely by analyzing historical price and volume data. Traders who employ technical analysis, often referred to as “technicians,” believe that past trading activity and price movements can provide clues about future market behavior. At the core of technical analysis lies the concept of market efficiency, which suggests that all available information is already reflected in a security’s price.

Technicians utilize a myriad of tools and techniques to decipher market patterns and trends. These include chart patterns, such as head and shoulders, triangles, and double tops/bottoms, which signal potential reversals or continuations in price movements. Additionally, technical indicators like moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence) aid in identifying overbought or oversold conditions and potential trend reversals.

By leveraging technical analysis, traders aim to make informed decisions about buying or selling stocks based on the analysis of price charts and market indicators. However, it’s important to note that technical analysis is not foolproof and is subject to interpretation, as market sentiment and other external factors can influence price movements.

**Candlestick Charting: Illuminating Market Sentiment**

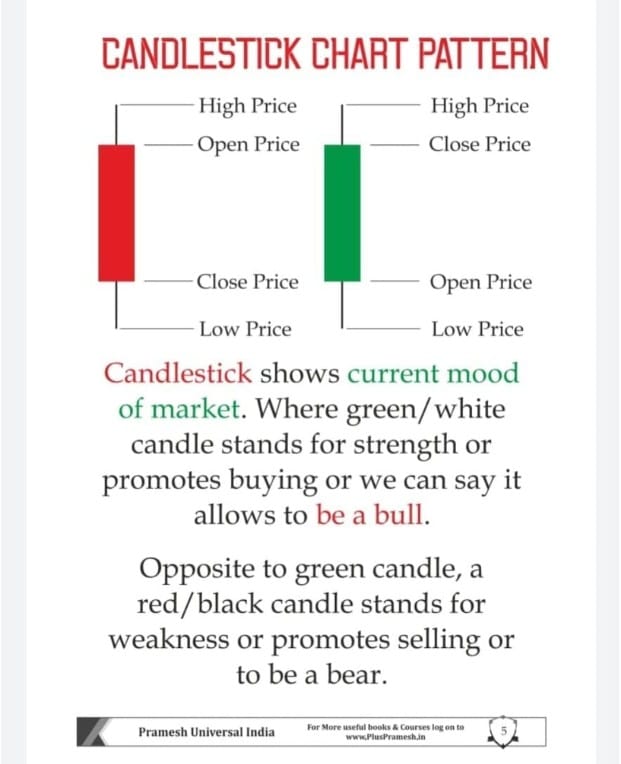

Candlestick charting is a form of technical analysis that originated in Japan centuries ago and has since become widely popular among traders globally. Candlestick charts visually represent price movements over a specified period, typically in the form of a single candlestick representing one trading session. Each candlestick comprises four primary components: the opening price, closing price, high price, and low price.

The shape and color of each candlestick convey vital information about market sentiment and price action. For instance, a bullish candlestick, often depicted in green or white, indicates that the closing price is higher than the opening price, suggesting buying pressure and upward momentum. Conversely, a bearish candlestick, usually depicted in red or black, signifies that the closing price is lower than the opening price, signaling selling pressure and downward momentum.

Candlestick patterns, such as engulfing patterns, doji, and hammer, offer valuable insights into potential market reversals or continuations. Traders often combine these patterns with other technical indicators to validate trading decisions and manage risk effectively.

**Integration and Application in Stock Investing**

Both technical analysis and candlestick charting play integral roles in the decision-making process of stock investing. While technical analysis provides a comprehensive framework for analyzing market trends and patterns, candlestick charting offers a nuanced perspective on market sentiment and price action. When integrated effectively, these methodologies empower traders to make well-informed investment decisions.

Successful stock investing requires a deep understanding of market dynamics, risk management principles, and a disciplined approach to trading. Traders must continuously adapt their strategies to evolving market conditions and remain vigilant in monitoring price movements and indicators.

In conclusion, technical analysis and candlestick charting serve as invaluable tools in the arsenal of stock traders and investors. By harnessing the power of these methodologies, traders can gain a competitive edge in navigating the complexities of financial markets and achieving their investment objectives. However, it’s essential to exercise caution and maintain a prudent approach to trading, recognizing that no strategy guarantees success in the ever-changing landscape of stock investing.

**Investing Strategies and Company Selection**

Investing in the stock market requires a well-thought-out strategy and careful selection of companies to invest in. Various strategies cater to different risk appetites, investment goals, and time horizons. Below are three common investing strategies along with examples of companies that align with each strategy:

1. **Value Investing:**

Value investing involves identifying undervalued stocks trading below their intrinsic value. Investors following this strategy typically look for companies with strong fundamentals but whose stock prices do not reflect their true worth. These investors believe that the market will eventually recognize the company’s value, leading to price appreciation.

| Company Name | Industry | Reason for Selection |

|——————|—————-|———————————————|

| Berkshire Hathaway (BRK.B) | Conglomerate | Diverse portfolio, strong financials |

| Johnson & Johnson (JNJ) | Healthcare | Consistent earnings, dividend stability |

| Coca-Cola (KO) | Consumer Goods| Established brand, global presence |

2. **Growth Investing:**

Growth investing focuses on identifying companies with strong potential for above-average growth in revenue, earnings, or cash flows. These companies often reinvest earnings into expansion, innovation, or market dominance, rather than paying out dividends.

| Company Name | Industry | Reason for Selection |

|——————|—————-|———————————————|

| Amazon.com Inc. (AMZN) | E-commerce | Continuous revenue growth, innovative leader|

| Tesla Inc. (TSLA) | Automotive | Disruptive technology, expanding market |

| Shopify Inc. (SHOP) | Technology | Rapid revenue growth, e-commerce platform |

3. **Dividend Investing:**

Dividend investing involves selecting stocks that consistently pay dividends. These stocks are typically associated with stable companies with mature business models that generate predictable cash flows.

| Company Name | Industry | Reason for Selection |

|——————|—————-|———————————————|

| AT&T Inc. (T) | Telecommunications | High dividend yield, reliable cash flows |

| Procter & Gamble Co. (PG)| Consumer Goods | Strong brand portfolio, dividend history |

| Exxon Mobil Corporation (XOM) | Energy | Historically high dividends, global presence |

Investors should conduct thorough research and consider their investment objectives, risk tolerance, and financial situation before implementing any strategy. Additionally, staying updated on market trends, economic indicators, and company performance is crucial for successful investing.